In an era defined by remote collaboration and digital transformation, diagramming software has evolved from a niche design tool into an essential platform for organizations seeking to visualize complex processes, streamline workflows, and enhance team productivity. The market reflects this shift dramatically, with valuations ranging from USD 2.85 billion to USD 6.05 billion in recent years, projected to reach between USD 5.12 billion and USD 14.25 billion by the mid-2030s. Growth rates consistently hover between 7.4% and 11% CAGR, signaling sustained demand across industries.

Microsoft Visio commands significant market presence with 27.6% mindshare, leveraging its deep integration with Microsoft 365 and established enterprise relationships. The platform excels in network diagrams, flowcharts, and technical documentation, making it particularly attractive for organizations already embedded in the Microsoft ecosystem. However, its licensing costs and Windows-centric approach can create barriers for budget-conscious teams or those operating across diverse platforms. Many enterprises also invest in AI personalization to tailor tools and increase user productivity.

Lucid Software follows closely at 22.9% in diagram categories, offering cloud-native solutions that prioritize real-time collaboration and accessibility. Draw.io, now operating as diagrams.net, has gained considerable traction as a free, open-source alternative that functions seamlessly in browsers and integrates with popular platforms like Confluence and Google Drive. This accessibility has made it especially popular among startups, educational institutions, and teams requiring straightforward diagramming without financial commitment.

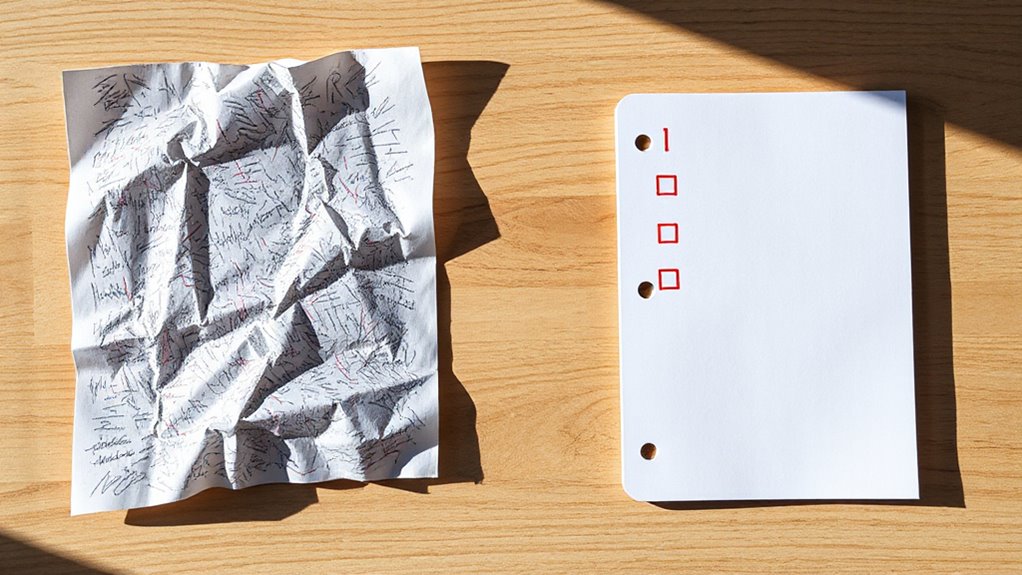

The broader competitive landscape includes JGraph, Cinergix, Slickplan, SmartDraw, and Creately, each targeting specific niches with specialized features. Cloud-based deployment now accounts for 65% of the market, driven by organizations where 72% of leaders are increasing virtual collaboration spending. AI-assisted diagram generation and low-code visual modeling represent emerging differentiators, with productivity gains reaching up to 72% through automation. Advanced diagramming platforms now leverage AI capabilities to auto-generate diagrams from code, reducing manual documentation time by up to 40%.

North America maintains dominance with 38-40% market share, though Asia Pacific demonstrates the fastest growth due to digital adoption among SMEs and expanding e-learning initiatives. Small and medium-size enterprises are forecasted to grow at the highest CAGR, reflecting increased digitalization among smaller organizations seeking cost-effective collaboration tools. Organizations evaluating options should prioritize integration capabilities, collaboration features, and total cost of ownership rather than focusing solely on feature counts, ensuring alignment with actual workflow requirements and team dynamics.